News Articles, Documents,

and Related Materials

Here is the Texas Economic Development Act that created the Chapter 313 tax incentives law, put into effect January 1, 2002. Click the link above to read.

For an easy overview, follow the above link to the Texas Comptroller's website for the quick read on the law that allows public school districts to offer tax incentives for businesses that "invest" in their communities.

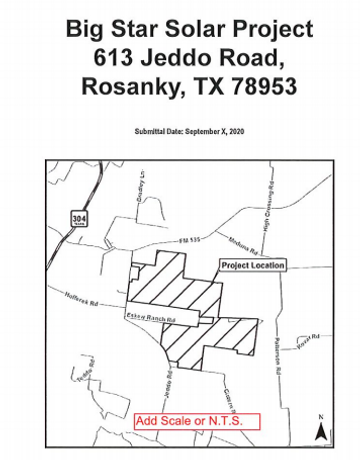

This is the proposed footprint of the 1,700 acre Rosanky Big Star Solar project. (NOTE: Map does not include recent 200 acre addition shown in middle of map.)

"The abatement is estimated to cost Smithville ISD over $10 million in accumulative property tax revenue losses."

Citizens for Responsible Solar

"Rural communities are under attack from big, corporate solar developers (some foreign) who want to build large-scale, industrial solar power plants on agricultural-and forestry-zoned land to take advantage of lower development costs. Citizens for Responsible Solar (CfRS) is dedicated to protecting the environment, historical landmarks, and landowners."

ARCHIVED READINGS

Read the 47-page application from RWE Renewables Americas LLC to Smithville ISD that was submitted to the Texas Comptroller's office.

An excerpt from the application for the tax break:

"The Company is currently considering several other projects in Texas (Stephens County, Jack County, Bee County, Kenedy County, Willacy County, San Patricio County and several others), Oklahoma (Vici complex, Major), Kansas (two project sites), Indiana, Illinois, plus Canada. The Company has received tax incentives on several of these projects which significantly improve the financial viability of the investment. RWE has not built a project in Texas that did not have a Chapter 313 agreement, as it is crucial to exceeding the company financial hurdle. RWE recently sold a project that was unable to get a Chapter 313 agreement, as it was unable to meet the minimum financial hurdle. Without a Chapter 313 agreement, this Project would probably not be built."

NOTE: RWE paid Smithville ISD a $75,000 filing fee for this application.

Required Reading: Initial Story on the solar farm from The Austin American-Statesman

Required Reading on Chapter 313 Funding from The Texas Observer

Chapter 313, the Texas Economic Development Act, is Texas’ largest corporate tax break program, with a lifetime cost to the state of more than $7 billion so far. There is no limit to the program. It was intended as a “deal-closing” program for companies that might go elsewhere, the state has been generous with tax giveaways, rejecting just three projects in 15 years, while approving more than 300.

Required Reading from The Houston Chronicle

"The Dunagans, whose 2.5 acre property would be surrounded by sun-catching panels, have discovered that the solar development would be like any other power generation installation. Fencing with razor wire would keep out intruders. Rollers would click throughout the day as panels on tracking devices rotate to face the sun. Hazardous chemicals contained in the panels pose threats of contamination."

Required Reading from The Texas Public Policy Foundation

NOTE: This article is a conservative viewpoint that includes citations from the progressive Texas Observer.

Bastrop County Development Permit Submitted by RWE Renewables

"RWE has long been among the top targets of climate activists, in part as a result of a long-running, high-profile battle to preserve a forest in western Germany that is threatened by the planned expansion of one of the group’s coal mines. RWE also operates some of the largest coal-fired power stations in Europe."

From The Smithville Times:

Smithville school board evaluates potential $10M tax breaks for $190M solar project

"[Superintendent Cheryl] Burns said during the meeting that a public forum will take place at a later date to receive more feedback and input about the proposed solar project and the potential tax breaks for it."

Tax Abatement Agreement between Bastrop County and Big Star Solar LLC

People are quick to get on board with renewable energy, but these cheerleaders don't seem to care about the consequences of the actions needed to get to "carbon neutrality." It doesn't matter if it's a lithium pit in Nevada or a solar farm in Rosanky — trees, land, endangered species, and people are plowed under for the sake of saving the planet (at what cost?) and to make rich corporations even richer.

The Battle of Thacker Pass

Electric cars require a lot of lithium. A showdown in Nevada shows that getting it won’t be easy.

"The company would dig the ore out of a 1,000-acre, 400-foot-deep open pit and concentrate the lithium on site in vats of sulfuric acid....But critics don’t want to see any resource, even one so important to the green energy transition, extracted at the expense of local ecosystems."

Required Reading from The Texas Tribune

April 29, 2021

A Texas economic incentive offers massive tax breaks to companies, but its renewal isn't a done deal

Chapter 313, a decades-old law designed to lure companies to Texas with property tax breaks, expires in 2022. Lawmakers looking to renew it face opposition from critics who say it's unfair to many Texas schools.

“These deals may – and I emphasize the word may – benefit a small number of school districts, but they provide more benefit to the businesses getting the tax breaks,” said Clay Robison, a public affairs specialist for the Texas State Teachers Association. “And they rip off the vast majority of Texas taxpayers, school districts and school children, who end up covering for the property tax revenue lost to each abatement deal."

Required Reading from The Houston Chronicle

April 29, 2021

Huge corporations are saving $10 billion on Texas taxes, and you're paying for it

Chapter 313 does create jobs — but at a steep price. By even a conservative measure, Texas is paying $211,600 in tax incentives for each job created under the program. Using a different metric cited in the past by state officials, the cost per job tops $1.1 million.

Senate Committee Hearing on HB4242, which would reauthorize Chapter 313 agreements for another two years.

May 18, 2021

Texas lawmakers are trying to decide if Chapter 313 agreements need to be terminated. The agreements are set to expire this year if they are not reauthorized by the legislature. HB4242 would allow 313's to live for another two years until lawmakers can figure this out. This video is from a Senate committee that heard from a few opponents. Unfortunately, the lieutenant governor is attempting to fast-track this item, and only 30 minutes of notice was given for the public to attend this meeting. This was not enough time for the Rosanky Rural Alliance to travel to Austin, even though several residents had planned to attend.

Required Reading from The Texas Observer

May 12, 2021

Texas’ Largest Corporate Welfare Program Is Leaving Companies Flush and School Districts Broke

“The value of property goes up on our homes. Why would the industries assume they should pay less?”